will capital gains tax rate increase in 2021

Schwab Charitable has been supporting charitable giving since 1999. 2021 Capital Gains Tax Rates Brackets Long-Term Capital Gains.

Can Capital Gains Push Me Into A Higher Tax Bracket

On April 28 2021 President Biden released the American Families Plan which included a proposal to increase the long-term capital gains.

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

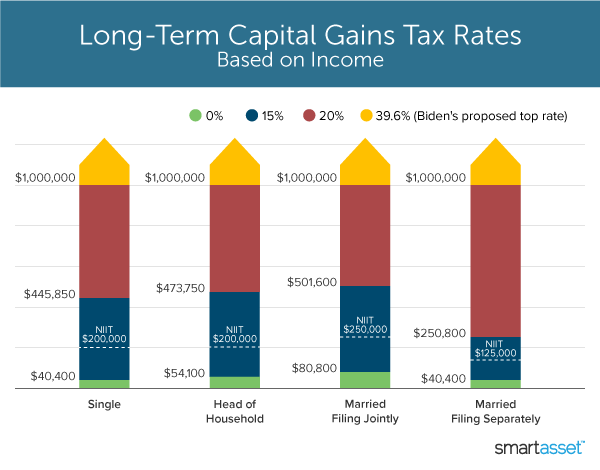

. The proposal would be effective for taxable years beginning after December 31 2021. Imposes a progressive income tax where rates increase with income. In 2021 long-term capital gains will be taxed at 0 15 or 20 depending on the investors taxable income and filing status excluding any state or local capital gains taxes.

That rate hike amounts to a staggering 82. By Freddy H. Discover Helpful Information And Resources On Taxes From AARP.

For the 2021 to 2022 tax year the allowance is 12300 which leaves 300 to pay tax on. President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends. The Federal Income Tax.

The 238 rate may go to 434 for some. Implications for business owners. First deduct the Capital Gains tax-free allowance from your taxable gain.

Ad Compare Your 2022 Tax Bracket vs. Here are 10 things to know. The Tax Foundation interprets individual tax burden by what taxpayers actually spend in local and state taxes rather than report these expenses from the state revenue.

Experienced in-house construction and development managers. The effective date for this increase would be September 13 2021. Posted on January 7 2021 by Michael Smart.

Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing. Events that trigger a disposal include a sale donation exchange loss death and emigration. Assume the Federal capital gains tax rate in 2026 becomes 28.

Add this to your taxable. The proposal would increase the maximum stated capital gain rate from 20 to 25. Unlike the long-term capital gains tax rate there is no 0.

The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. Ad Download The 15-Minute Retirement Plan by Fisher Investments. If you have a 500000 portfolio be prepared to have enough income for your retirement.

House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee. Most realized long-term capital gains. Weve got all the 2021 and 2022 capital gains.

Ad See why Urban Catalyst is a trusted leader in opportunity zone fund investing. Ad Donate appreciated illiquid assets and give even more to charity. Increase Tax Rate on Capital Gains Current Law.

Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. But the tax rate that will apply to your long-term capital gains does depend on what your taxable income rate is. Its time to increase taxes on capital gains.

Hundred dollar bills with the words Tax Hikes getty. Note that short-term capital gains taxes are even higher. The Chancellor will announce the next Budget on 3 March 2021.

Experienced in-house construction and development managers. Free easy returns on millions of items. Your 2021 Tax Bracket To See Whats Been Adjusted.

To address wealth inequality and to improve functioning of our tax. Ad Free shipping on qualified orders. With average state taxes and a 38 federal surtax.

A taxpayer has a 1 million long-term capital gain on December 31 2021 and invests it into an Opportunity Zone Fund. The following are some of the specific exclusions. Many speculate that he will increase the rates of capital.

The plan also proposes changes to long-term capital gains tax rates nearly doubling the tax rate for high-income individuals by increasing it from 20 to 396.

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

How Are Dividends Taxed Overview 2021 Tax Rates Examples

What S In Biden S Capital Gains Tax Plan Smartasset

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Capital Gains Tax What Is It When Do You Pay It

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Capital Gains Tax Regime Needs To Be Tweaked Revenue Secretary Tarun Bajaj Business Standard News

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)